When an estate goes through probate in Saskatchewan, the executor is responsible for paying probate fees. These fees are determined by the total value of the estate and are required before the Court of King’s Bench grants probate. This guide explains the probate fee structure in Saskatchewan for 2025 and how they apply to different estate sizes.

Saskatchewan Probate Fee Structure for 2025

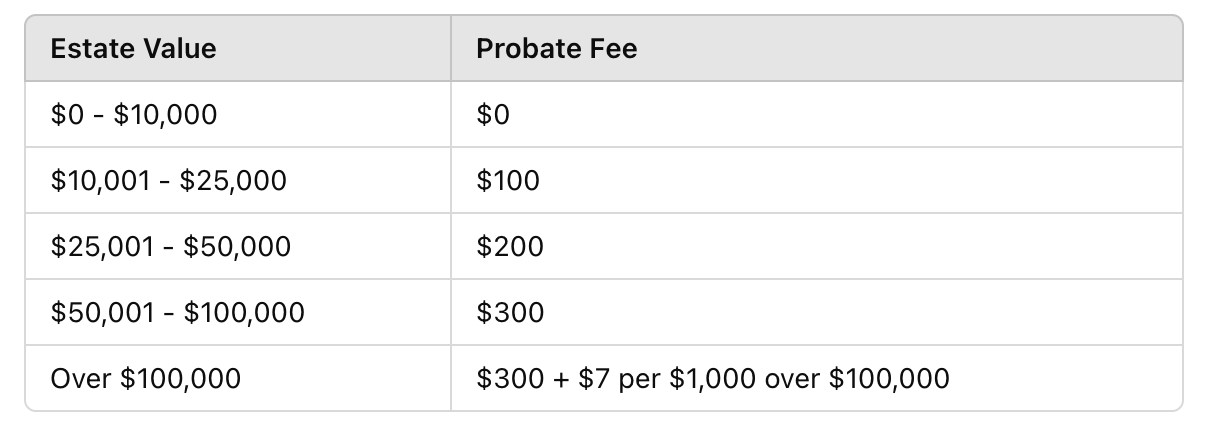

Saskatchewan probate fees are based on the total value of the deceased’s assets. The fee schedule is as follows:

The probate fee is calculated on the total value of the estate, which includes real estate, bank accounts, investments, and personal property that do not have a designated beneficiary or joint ownership.

For official fee details, visit the Saskatchewan Law Courts probate page.

Who Pays the Probate Fees?

Probate fees are paid by the estate before assets are distributed to beneficiaries. The executor is responsible for ensuring that fees are covered using estate funds. If the estate lacks sufficient liquid assets, the executor may need to sell assets to cover probate costs.

When Are Probate Fees Paid?

Probate fees must be paid when submitting the Application for Grant of Probate to the Court of King’s Bench. The application must also include:

- The original will and any codicils.

- A death certificate.

- A complete list of estate assets and liabilities.

- The executor’s affidavit affirming their role and responsibilities.

The court will not process the application until probate fees are paid in full. Learn more about probate applications at the Public Legal Education Association of Saskatchewan.

Can You Avoid Probate Fees in Saskatchewan?

While probate is required for many estates, there are ways to minimize or avoid probate fees:

- Joint Ownership: Assets held in joint tenancy with a right of survivorship do not require probate.

- Named Beneficiaries: RRSPs, TFSAs, and life insurance policies with designated beneficiaries bypass probate.

- Gifting Assets Before Death: Transferring assets before passing can reduce the estate’s total value.

- Creating a Trust: A properly structured trust can help keep assets out of the probate process.

For additional strategies on estate planning and minimizing probate costs, consult an estate lawyer or visit the Saskatchewan Law Society.

Saskatchewan probate fees in 2025 depend on the estate’s total value, with larger estates incurring higher fees. Executors should prepare for these costs when managing an estate and explore strategies to minimize probate where possible. If you are unsure whether probate applies to your estate, legal and financial professionals can provide valuable guidance.

Disclaimer: This article is for informational purposes only and does not constitute legal or financial advice. Please consult a qualified professional for guidance on probate matters in Saskatchewan.